Certified Public Accountants (CPAs) face immense pressure during tax season. With client demands, regulatory changes, and tight deadlines, the workload can become overwhelming. This is where Accounting Virtual Assistants (AVAs) prove invaluable. These professionals handle routine and administrative tasks, allowing CPAs to focus on high-level financial analysis and strategic planning.

What Exactly Are Accounting Virtual Assistants?

Accounting Virtual Assistants are remote professionals who specialize in supporting accountants and CPA firms. Highly trained in financial processes and accounting software, they can take over various jobs, such as:

- Data entry and transaction categorization

- Reconciling bank and credit card statements

- Organizing and digitizing receipts and records

- Client communication

- Running standard reports and preparing financial summaries

By delegating these tasks to AVAs, CPAs can significantly boost productivity, especially during peak tax times.

How AVAs Streamline the Tax Preparation Process

There are several key ways in which AVAs simplify and speed up tax preparation for CPAs:

1. Accurate and Timely Data Entry

One primary cause of tax season stress is last-minute data entry. AVAs manage this task proactively. They maintain books consistently throughout the year, ensuring all financial data is up-to-date and error-free by tax season.

Example: An AVA can reconcile monthly statements, categorize expenses, and flag any discrepancies, reducing the risk of inaccuracies during filing.

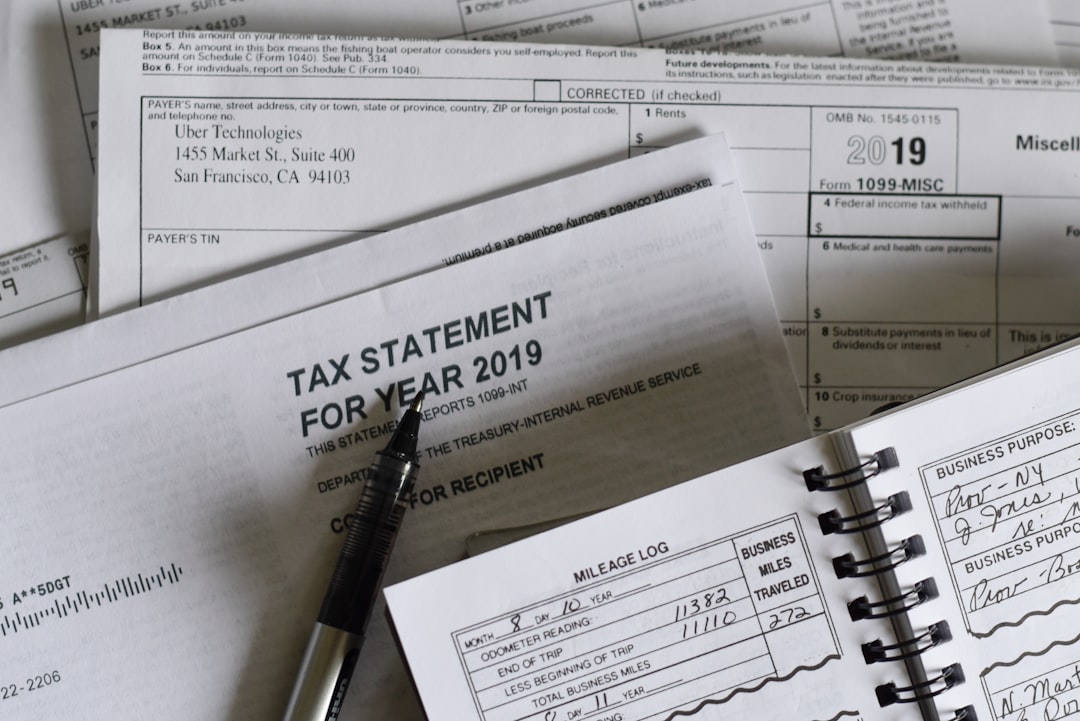

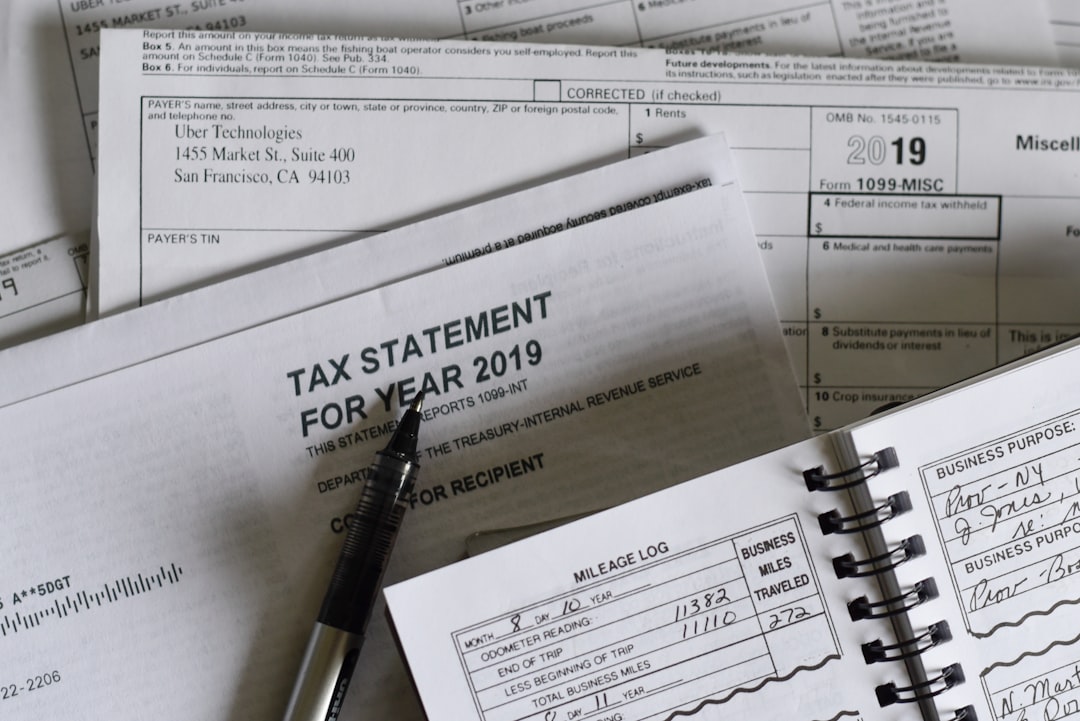

2. Seamless Organization of Tax Documents

Gathering and organizing client documents such as W-2s, 1099s, and receipts can be time-consuming. AVAs create systematic digital filing methods so that all records are easily accessible.

They also follow up with clients for missing information, allowing CPAs to concentrate solely on tax calculations and filing.

3. Leveraging Software Tools

Modern AVAs are proficient in accounting tools such as QuickBooks, Xero, FreshBooks, and tax platforms like TurboTax and Drake. Their technological proficiency helps integrate systems and automate routine functions.

For instance, recurring tasks such as scheduled invoices, payment reminders, and report generation can be largely automated without CPA intervention.

4. Enhancing Client Communication

Effective communication with clients during tax season is critical. AVAs can manage emails, schedule appointments, send reminders, and gather needed paperwork in a timely manner.

This allows CPAs to nurture stronger relationships with their clients while juggling multiple accounts efficiently.

5. Reduced Operational Costs

Hiring in-house administrative and bookkeeping staff can be costly, especially during seasonal surges. Remote AVAs offer a cost-effective alternative with flexible hiring models—weekly, monthly, or per project—without compromising quality.

In short, a CPA working with an AVA gains not only time and efficiency during stressful periods but also long-term organizational growth.

Case Study: Real Benefits for a Mid-Sized CPA Firm

GreenFlag Accounting, a mid-sized CPA firm in Ohio, began using two accounting virtual assistants during the 2022 tax season. Thanks to their support, the firm reduced return preparation time by 30%. Also, client satisfaction scores improved due to better responsiveness and organized tax documentation.

GreenFlag also experienced fewer errors in returns, attributing the improvement to consistent record-keeping and review processes overseen by their AVAs throughout the year.

Final Thoughts

For CPAs looking to minimize stress, shorten turnaround time, and increase accuracy during tax season, partnering with Accounting Virtual Assistants is a strategic decision. The blend of technology, expertise, and affordability they offer creates a smarter foundation for handling tax preparation and client service.

Frequently Asked Questions (FAQ)

-

Q: What qualifications should an Accounting Virtual Assistant have?

A: Ideally, an AVA should possess basic accounting knowledge, be proficient in software like QuickBooks or Xero, and have experience with tax-related documentation and procedures. -

Q: Are AVAs secure when handling sensitive client financial data?

A: Reputable AVAs and agencies follow strict data protection protocols, including NDAs, encryption tools, and secure file-sharing practices. -

Q: Can AVAs communicate directly with my clients?

A: Yes, they can handle emails, appointment scheduling, and document follow-ups professionally, provided there’s clear guidance on your firm’s communication standards. -

Q: How is the work of an AVA managed and monitored?

A: Most virtual assistant services offer regular reports, progress tracking dashboards, and tools like time-trackers to provide full transparency. -

Q: Will hiring an AVA save me money compared to hiring in-house?

A: Absolutely. With an AVA, CPAs pay only for the work needed, often at a lower hourly rate and with no overhead costs such as office space or employee benefits.